- AlphaInsights by Alpha Impact 8 Ventures

- Posts

- Is a recession out of sight? 🔭💸🫡

Is a recession out of sight? 🔭💸🫡

Week of October 7th, 2024

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

🦄 STARTUPS

ROUNDS AND UNICORNS

The Week’s Biggest Funding Rounds: OpenAI On Top — By A Lot (5 minute read)

OpenAI (AI): raised $6.6 billion at a $157 billion valuation, led by Thrive Capital. Investors include SoftBank, Microsoft, and Nvidia. This funding aims to support the company’s transition from a nonprofit to a for-profit benefit corporation amidst internal challenges

Poolside (AI): secured $500 million in a Series B round led by Bain Capital Ventures, valuing the startup at $3 billion. It develops AI software for programmers and has raised a total of $626 million since its May 2023 founding

Kailera Therapeutics (biotech): launched with a $400 millionSeries A round co-led by Atlas Venture and Bain Capital Life Sciences, focusing on therapies for chronic weight management

Aktis Oncology (biotech): closed a $175 million Series B round led by Janus Henderson Investors, focusing on targeted alpha radiopharmaceuticals for solid tumors

Impulse Space (space): raised $150 million in a Series B round led by Founders Fund, developing orbital transfer vehicles for space cargo delivery

The startup fundraising environment has become more challenging compared to two years ago, marked by notable declines in startup valuations and longer intervals between funding rounds. In Q2 2024, the median valuation increase for startups raising Series A rounds was 2.8x, down from 4.9x in Q2 2022. At Series C, the median valuation step-up fell to 1.6x from 2.5x over the same period

The median time between seed and Series A rounds increased from 607 days in 2022 to 712 days in 2024. For Series B to Series C, the gap grew from 681 days to 856 days

The median size of seed rounds rose to $3.2 million in Q2 2024, higher than any quarter since the peak in late 2021/early 2022

INDUSTRY

OpenAI valuation surpasses every VC-backed IPO (2 minute read)

OpenAI has completed a $6.6 billion financing round, achieving a valuation of $157 billion, the highest for any VC-backed company at IPO, surpassing Meta, Uber, Rivian, and Coinbase. Led by Thrive Capital, the financing included participation from Microsoft, Nvidia, Fidelity, and others

This positions OpenAI as the third-most valuable VC-backed company globally, behind Elon Musk's SpaceX at $180 billion and ByteDance at $220 billion

The company's significant capital raise reflects the high costs associated with developing AI models

For comparison, Musk's xAI raised over $6 billion this year at a valuation of $24 billion, while competitor Anthropic was valued at $19.35 billion in January

INDUSTRY WORLDWIDE

The third quarter of 2024 saw a mixed landscape for startup funding in North America, with a 10% sequential decline in investment to $40.5 billion, despite a 22% year-over-year increase. This slowdown in funding was offset by strong interest in AI, which attracted nearly $15 billion in investment

Late-stage funding grew by 28% from the previous quarter, reaching $23.8 billion across 246 rounds. Major deals included Alphabet's $5 billion investment in Waymo

Early-stage funding declined by 39%, totaling $13.5 billion, with a notable $1 billion round for Safe Superintelligence leading the charge

Seed stage investment decreased to $3.3 billion across about 1,207 rounds, marking the lowest totals in years

The exit landscape included several significant acquisitions, like Mastercard's $2.65 billion purchase of Recorded Future and a few biotech IPOs, though the overall IPO market remained sluggish

Global Funding Slowed In Q3, Even As AI Continued To Lead (5 minute read)

In Q3 2024, global venture funding totaled $66.5 billion, marking a 16% decline from the previous quarter and a 15% drop from the same quarter last year. This continues a trend of decline over the last nine quarters, with this being only the second quarter below the $70 billion mark since the downturn began

Late-stage funding experienced the most significant YoY drop, especially in large rounds ($500 million and above), with total late-stage investment at $34.7 billion, down from $46 billion in Q3 2023

Early-stage funding remained stable YoY at $24.7 billion, despite a QoQ decline attributed to a large round in Q2 2024 skewing earlier numbers

Seed funding decreased to $7 billion, reflecting declines both QoQ and YoY

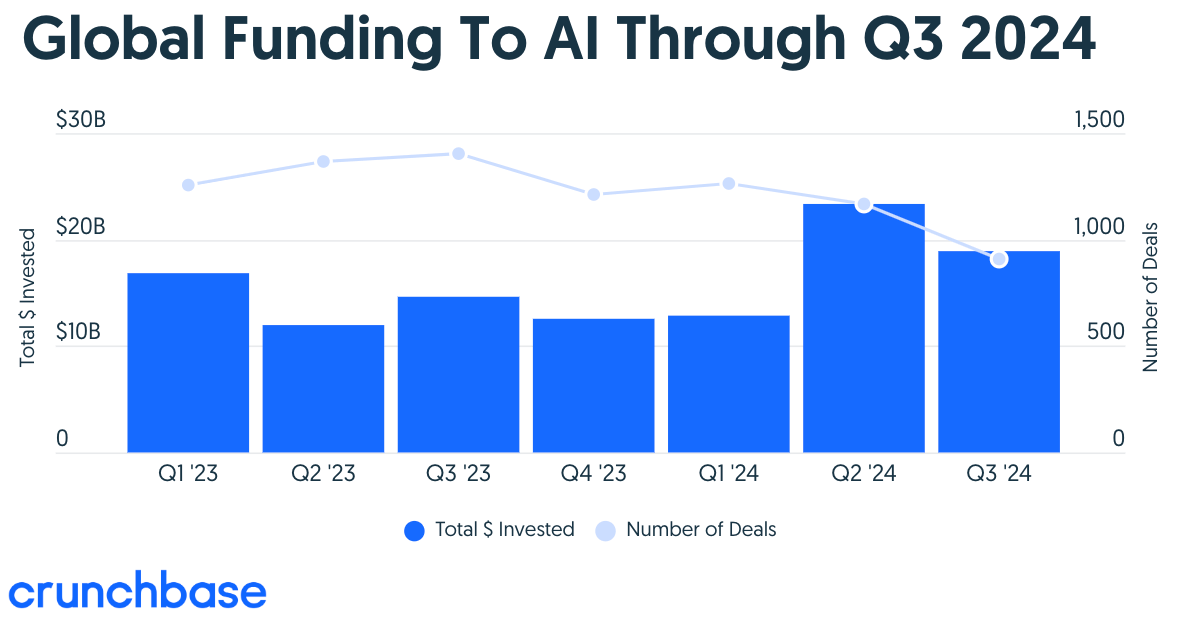

AI led investments, attracting nearly $19 billion (28% of total funding), followed by healthcare and biotech ($15 billion) and hardware ($13 billion)

🏦 ECONOMIC SNAPSHOT

US jobs report crushes expectations as economy adds 254,000 jobs, unemployment rate falls to 4.1% (5 minute read)

In September, the U.S. labor market surpassed expectations by adding 254,000 jobs, significantly more than the 150,000 forecasted by economists. The unemployment rate also unexpectedly dropped to 4.1% from 4.2% in August. Revisions to previous months' data showed an additional 72,000 jobs created in July and August combined

Wage growth rose to 4% YoY, up from 3.9%, with a 0.4% increase in wages from the previous month

This stronger-than-expected report suggests less urgency for the Fed to cut interest rates further, with market expectations for a half-point cut in November dropping from 53%* to about 5%

The labor force participation rate remained steady at 62.7%, with notable job gains in food services (+69,000), healthcare (+45,000), and government (+31,000)

The Blowout Jobs Report Shows the Federal Reserve Made a Mistake (5 minute read)

The U.S. economy is performing better than expected, raising questions about the Federal Reserve's decision to implement a significant rate cut. In September, employers added 254,000 jobs, the highest monthly increase since January. While many of the new jobs are in government, the overall economic indicators suggest the Fed could have opted for a smaller 25-basis-point cut instead of the 50-basis-point cut in September

Analysts, including Gene Goldman from Cetera Investment Management, express concern that this aggressive rate reduction may pose risks to the economy

Following the strong jobs report, Bank of America has adjusted its forecast for the November Fed meeting, now predicting a 25-basis-point cut rather than 50

Analysts note that a resilient labor market can support consumer spending while the Fed cuts rates, typically benefiting stocks and bonds over cash

US economy now faces 15% risk of entering recession (4 minute read)

Goldman Sachs has reduced the likelihood of the USA entering a recession within the next 12 months to 15% down five percentage points. The decision follows a positive employment report, which indicated the highest job gains in six months for September and a drop in the unemployment rate to 4.1%

Goldman Sachs continues to predict two consecutive 25 basis point cuts, with a terminal rate between 3.25% and 3.5% by June 2025

The Fed recently cut its policy rate by 50 basis points in September to the 4.75%-5.00% range, its first reduction since 2020

Financial markets have increased the likelihood of a quarter-percent reduction in November to 95.2%, up from 71.5% before the employment report

🌱🌎 Impact & Climate Resilience

US VC female founders dashboard (5 minute read)

Despite increasing efforts to support women-led startups, female founders continue to receive a disproportionately small share of VC funding. Female founders are particularly underrepresented in high-tech sectors such as software and hardware, where funding is more substantial. There has been a slight improvement in funding for female founders over recent years, but significant gaps persist

In terms of venture capital deal count, so far this year, only startups with female founders received 6.4% of the total VC deals, while startups with both female and male founders received 18.5%

For VC capital, companies founded only by women received 2.4%, while companies with both female and male founders received 19.4%

For female-founded US companies, in Q2 2024, $8.7 billion was invested in 817 deals. In Q3, capital invested was $7.2B with 595 deal counts

🚀 IPO & Exits

AI chipmaker Cerebras files for IPO to take on Nvidia (4 minute read)

Artificial intelligence chip startup Cerebras Systems filed for an IPO on Sept the 30th, aiming to trade under the ticker symbol “CBRS” on the Nasdaq. Competing primarily with Nvidia, Cerebras promotes its WSE-3 chip, which boasts more cores and memory than Nvidia's H100, though it is physically larger

In its filing, Cerebras reported a net loss of $66.6 million on $136.4 million in sales for the first half of 2024, an improvement from the same period in 2023

Cerebras highlighted its dependence on Group 42, an AI firm that accounted for 83% of its revenue last year. Its competitors include Nvidia, AMD, Intel, Microsoft, and Google, along with various private companies

Cerebras is backed by significant investors including Foundation Capital and Benchmark. It was valued at over $4 billion in a 2021 funding round

The company plans to use Citigroup and Barclays for its IPO, as the tech IPO market remains cautious in 2024 due to higher interest rates

Shein's founder, Sky Xu, has traveled to the UK to meet with investors in anticipation of a potential listing on the London Stock Exchange. This visit highlights Shein's efforts to secure regulatory approvals in both China and the UK

These informal meetings are not part of an official roadshow, and if approved for an IPO in the UK, a listing is expected early next year

Shein, valued at $66 billion, has disrupted the fast-fashion industry. However, the company faces allegations related to forced labor and environmental issues, which it denies

Initially targeting a New York IPO, Shein shifted to London after facing regulatory hurdles in the US. The company has filed confidential paperwork with the UK's financial regulator for the listing and is currently undergoing due diligence

🗞️ AI8 VENTURES HIGHLIGHT

Alpha Showcase 2024: Thank you Mexico City!

What an incredible experience at the NAA International Symposium and Startup Pitching Competition!

On September 25th, we hosted the Startup Pitching Competition for the NAA’s first-ever International Symposium in Mexico City. The event featured four exceptional early-stage startups, each selected through a rigorous process, showcasing their energy and innovative ideas to an audience of over 100 allocators and industry leaders. We hope the Symposium and Competition inspired you and helped elevate your journey to success.

A huge shoutout to Yoel Gavlovski and the entire Quash team, congratulations on your well-deserved victory! The competition was fierce, and every participant truly brought their A-game to the pitches. Thank you all for making this such a memorable event!

About the NAA: Founded in 1999, the New America Alliance is dedicated to advancing the economic development of the American Latino community. We believe that Latino business leaders have a special responsibility to lead the way in building the forms of capital crucial to Latino progress – economic, political, human, and philanthropic. Through coordinated philanthropy and strategic public and private collaboration, we aim to drive investment in our community.

Alpha Insights: 2024 Venture Capital Report

Alpha Impact 8 Ventures is thrilled to share our latest insights into the dynamic world of investments with our 2024 Venture Capital Report.

Last year, Michael Burry, the legendary fund manager who famously profited from shorting the US housing market in 2008, bet more than $1.6 billion on a Wall Street crash by shorting the S&P 500 and Nasdaq-100. Nothing happened.

This year, Warren Buffett’s cash reserves reached a record $276.9 billion as Berkshire Hathaway trimmed its stock holdings in Apple. Some view it as a routine adjustment, while others speculate that Buffett perceives an overheated, overvalued market.

Everyone talks about a soft landing, but warning signs are flashing and the world seems to be teetering on a delicate balance. Is there something we’re missing? Is there an unseen factor at play?

Check Beyond Survival: Opportunities in Climate Change

It all started in 2010 after a great conference with Mr. Al Gore. I was in Mexico City attending an event where Mr. Gore presented what the climate would look like if we did not act quickly and reduce our carbon emissions. That day, Mr. Gore’s team made his “models” available for everyone to study and play with. He told me that the largest desert in the world would be what used to be Mexico, California, Nevada, Arizona, New Mexico, and Texas, all the way to the State of Mexico. He didn’t know if Mexico City would be a part of it because of its altitude. That day, we walked several miles to our dinner because of the bad news.

Your best effort is fine; we don’t need 20% of the people doing everything right. We need 80% of the people doing their best

Introducing: Climate Resilience Technology

Alpha Impact 8 Ventures is pleased to announce that we are adding a third investment vertical to our thesis: Climate Resilience Technology.

Climate Resilience Technology encompasses digital solutions designed to help communities, businesses, and ecosystems adapt to and recover from the impacts of climate change. We're looking for scalable technologies addressing existing problems caused by climate change.

Our focus areas include:

AgFinancing: Integrating advanced technologies and tailored financing solutions to improve access to capital for agricultural growth and trade, enhance food security, boost productivity, predict disruptions, and optimize logistics.

Water Management Systems: Utilizing advanced technologies and financing solutions to address water scarcity and inefficient water use exacerbated by climate change.

Energy Management and Optimization: Implementing advanced technologies and financing solutions to tackle increased energy demand and grid instability due to extreme weather conditions. This includes smart grids, microgrids, energy management software, and demand response systems that optimize energy use, integrate renewable energy sources, and enhance grid resilience.

Data, Analytics, and Predictions: Companies that utilize data and advanced analytics to predict and mitigate disruptions and climate-related events. These solutions provide crucial insights and foresight, helping communities and businesses to prepare and respond effectively to climate challenges. Advanced technologies and artificial Intelligence to enhance supply chain visibility, predict disruptions, and optimize logistics ensure continuity and efficiency.

Alpha Impact 8 Ventures is disrupting the industry, generating wealth, creating technology, providing access, leveling the play field, reducing systemic barriers, and building a resilient world.

Become part of the our revolution.

Happy reading,

AI8 Ventures’ Research & Investment Team