- AlphaInsights by Alpha Impact 8 Ventures

- Posts

- Job report shows solid growth—are recession fears behind us? 💼😰

Job report shows solid growth—are recession fears behind us? 💼😰

Week of September 9th, 2024

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

🦄 STARTUPS

ROUNDS AND UNICORNS

The Week’s Biggest Funding Rounds: Safe Superintelligence Leads With Massive $1B Raise (5 minute read)

Safe Superintelligence (AI): AI research lab Safe Superintelligence raised $1 billion from top investors like Andreessen Horowitz and Sequoia Capital, valuing the company at $5 billion

Arsenal Biosciences (Biotech): the cell therapy startup from South San Francisco, secured $325 million in a Series C round. The company is developing T-cell therapies for solid tumors, including ovarian, kidney, and prostate cancers

eGenesis (Biotech): raised $191 million in a Series D led by Lux Capital. The company, which focuses on human-compatible engineered organs, recently achieved the first successful transplant of a genetically engineered pig kidney to a human

Circle Pharma (Biotech): Circle Pharma, a biotech company developing cell-permeable macrocycles for therapies, raised $90 million in a Series D round

24M Technologies (Battery): Battery tech startup 24M Technologies raised $87 million in a Series H round led by Nuovo Plus, valuing the company at $1.3 billion

Global venture funding reached $18 billion in August 2024, marking the lowest monthly total so far this year. This represents a 36% drop from July and a 23% decrease from August 2023. Monthly funding had remained above $20 billion until this dip, though similar fluctuations occurred in 2023

Despite the decline, funding patterns are seen as cyclical, with Q2 2024 showing an uptick due to large $100 million-plus mega rounds

North America led funding in August, accounting for 66% of global venture capital, the highest share this year

Asia-based companies received 25% of the total, while Europe saw only 7%, the lowest proportion in 2024

AI dominated funding, securing $4.3 billion, or 24% of the total, followed by healthcare and biotech with $3.5 billion

INDUSTRY

AI craze is distorting VC market, as tech giants like Microsoft and Amazon pour in billions of dollars (7 minute read)

Venture capitalists are struggling with a stagnant IPO market, despite a boom in AI startups. Unlike previous tech booms, where VCs were central, this AI surge is dominated by major tech giants like Microsoft, Amazon, Alphabet, and Nvidia. These companies are investing heavily in AI firms such as OpenAI and Anthropic, providing not only capital but also cloud credits and strategic partnerships, which VCs cannot match

As a result, VCs face difficulties exiting investments as the IPO market remains weak. U.S. VC exit values are projected to drop 86% from 2021 levels, and IPOs are expected to be at their lowest since 2016

This year, $26.8 billion has been invested in AI, a significant increase from $25.9 billion in 2023

AI firms are primarily funded by large tech companies and strategic investors, leading to a skewed investment landscape. VCs are mostly investing in application-level startups rather than infrastructure businesses, which require less capital

Crypto’s Venture Capital Gap (5 minute read)

Decentralization in Web3 may be stifling innovation due to the dispersal of venture capital and resources, contrasting with the Bay Area's centralization in Web2, which created a clear innovation hub. In Web2, founders developing AI products flocked to the Bay Area for its concentration of VCs, talent, and accelerators, despite high living costs and visa challenges

Today, global innovators in regions like Africa, South America, and Southeast Asia often struggle to scale their projects without such centralized support

Emerging hubs like New York, Lisbon, and Singapore are developing, but building bridges between top builders and venture capital is crucial

Initiatives like Developer DAO and events such as ETH Accra are addressing these gaps

Startups like Carta and Pulley recently faced business license revocations for missing state tax deadlines, highlighting the broader challenge of maintaining compliance with complex state-level regulations

Many startups neglect state registration and tax requirements due to limited resources or focus on customer-facing solutions

Non-compliance can lead to fines, back taxes, or legal risks, particularly during audits, acquisitions, or lawsuits

Each state has different, often outdated, processes, making compliance difficult

Nvidia is suddenly in trouble (3 minute read)

Nvidia, the prominent AI chipmaker, saw its stock plummet by 9.5% on Tuesday, Sept 3rd, erasing $279 billion in market value, a record drop surpassing Meta's 2022 decline

This sharp fall, driven by investor concerns over AI stock valuations and Nvidia's subdued outlook despite strong earnings, has also been exacerbated by a reported antitrust investigation by the US Justice Department

CEO Jensen Huang's personal wealth dropped by $10 billion, and the stock has fallen over 20% since June's peak

Despite these challenges, Nvidia remains a major force in the AI industry with a $2.7 trillion market valuation, and some analysts view the downturn as a potential buying opportunity

INDUSTRY WORLDWIDE

During a recent meeting in Tianjin, Beijing's Commerce Vice-Minister Wang Shouwen expressed concerns over Washington’s Section 301 tariffs and investigations targeting Chinese imports and industries, as well as investment restrictions. These tariffs, initially imposed in 2018 and recently expanded in May 2024 to cover products like solar panels, electric vehicles, and lithium-ion batteries, are seen by the U.S. as a response to Beijing’s unfair trade practices

Wang also addressed broader issues including national security measures, sanctions against Chinese enterprises, and restrictions on investments

Job openings for Chinese products affected by these tariffs declined by 1.1 million over the year, with the U.S. urging China to clarify national security boundaries

Both sides agreed to continue communication on various trade and economic issues

🏦 ECONOMIC SNAPSHOT

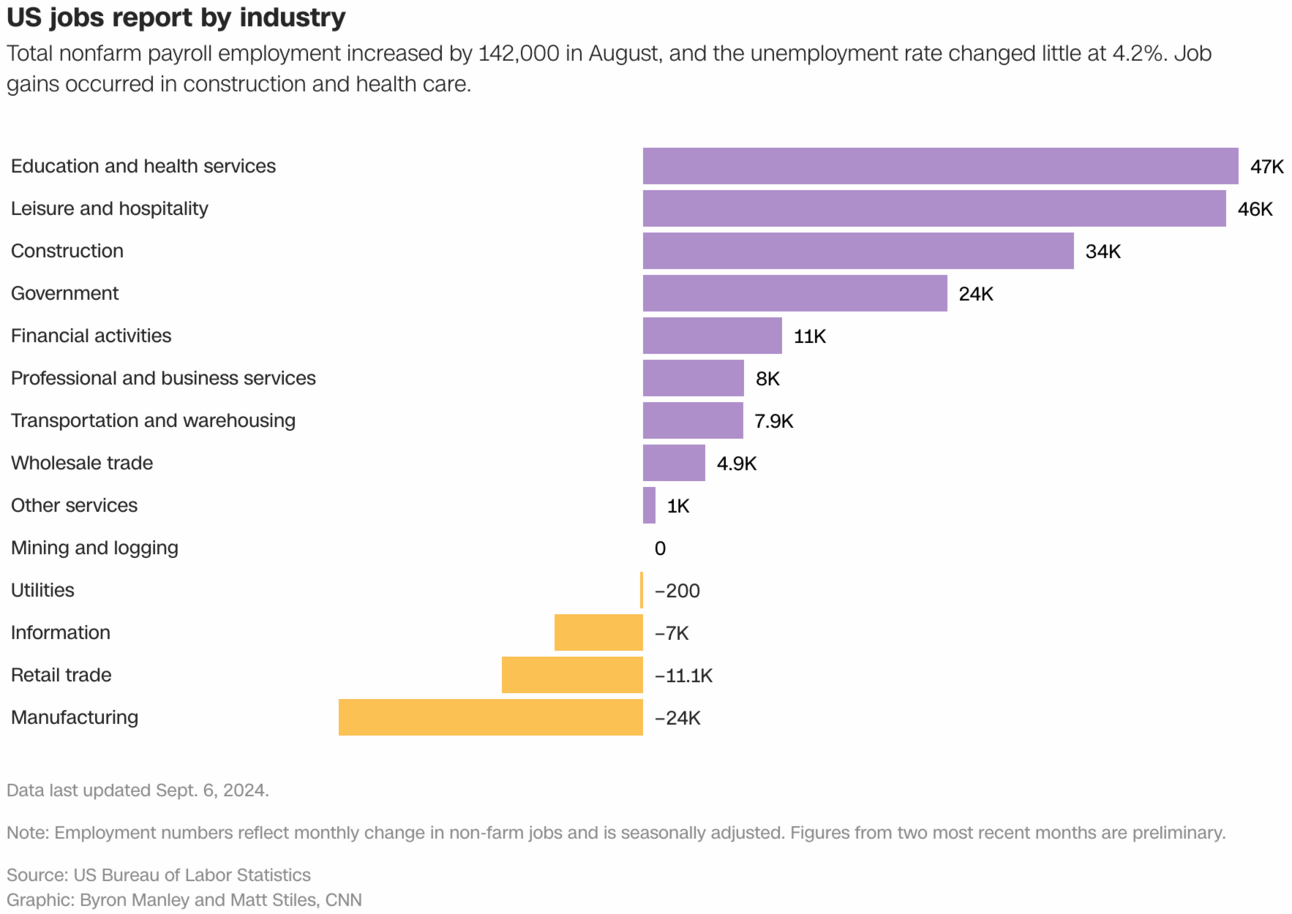

In August, the U.S. labor market showed resilience with 142,000 jobs added, rebounding from a weaker July, which saw job gains revised down to 89,000. The unemployment rate fell to 4.2% from 4.3%, aligning with economists' expectations

Despite ongoing concerns over job growth slowing amid high interest rates, key sectors like health care, leisure, and construction showed strong gains

With inflation under control, the Fed is expected to implement a modest rate cut, with the labor market still holding steady despite challenges

Job Opportunities Are Drying Up. Stock Market Investors Know it (4 minute read)

The S&P 500 experienced its largest weekly drop of 4.1% since March 2023, driven by a series of weak job reports. In August, the U.S. added 142,000 non-farm jobs, falling short of the 160,000 forecasted, while the unemployment rate slightly decreased to 4.2%

Despite these indicators of a softening labor market, economists like Seth Carpenter and Chris Zaccarelli suggest the economy is still expanding and not facing an imminent recession

Market speculation is focused on the Federal Reserve’s upcoming interest rate decision, with a 70% probability of a 25-basis-point cut and 30% for a larger reduction

The CPI report due on Wednesday could further influence these expectations, with a forecasted cooling to 2.6%, the lowest since March 2021

Don’t bet on inflation staying boring (5 minute read)

Despite inflation in advanced economies nearing target levels, significant volatility is expected to continue. Current indicators show five-year inflation swaps in the Euro Area and the US are approaching their targets, and long-term inflation forecasts are stabilizing around 2% for the Euro Area and adjusted for the US

However, factors such as difficulties in calibrating central bank policies, activist fiscal measures, and shifting inflation expectations will likely lead to persistent inflation volatility

Tight labor markets, reduced global supply chain resilience, and rising costs associated with climate change and AI expansion add to the uncertainty

Therefore, inflation is expected to remain volatile, challenging the notion of a return to a stable, low-inflation environment

Asian Stocks Tumble as Concerns on US Economy Sinks Tech Shares (4 minute read)

Asian equities hit their lowest point in over three weeks due to concerns about U.S. economic growth, sparked by weak non-farm payroll data. The MSCI Asia Pacific Index dropped as much as 1.8%, with major tech stocks like Taiwan Semiconductor and Samsung Electronics leading the decline

Markets in Japan, Taiwan, and Hong Kong saw significant losses, while Chinese shares struggled due to deflationary pressures

Investors are cautious as they await the Federal Reserve's upcoming rate cut decision, with global markets continuing to experience volatility

Key sectors affected include energy stocks in India, which declined due to falling oil prices, while shares in Chinese real estate and medical equipment saw mixed performance

Banks see earnings rise 11.4 percent in second quarter (5 minute read)

In the second quarter of 2024, Federal Deposit Insurance Corporation (FDIC)-insured U.S. banks saw a net income increase of 11.4%, reaching $71.5 billion, driven primarily by a 2.4% reduction in noninterest expenses, including a $4 billion drop related to the FDIC special assessment

Gains in equity security transactions and a $4.9 billion after-tax gain from the sale of an insurance division further contributed

Community banks, representing 4,104 of the 4,539 institutions, saw a 1.1% rise in net income to $6.4 billion

Other key metrics include a slight decline in net interest margin to 3.16%, a 1.0% rise in total loan and lease balances, and a $197.7 billion decrease in domestic deposits

🌱🌎 Impact & Climate Resilience

US VC female founders dashboard (5 minute read)

Despite increasing efforts to support women-led startups, female founders continue to receive a disproportionately small share of VC funding. Female founders are particularly underrepresented in high-tech sectors such as software and hardware, where funding is more substantial. There has been a slight improvement in funding for female founders over recent years, but significant gaps persist

In terms of venture capital deal count, so far this year, only startups with female founders received 6.5% of the total VC deals, while startups with both female and male founders received 18.4%

For VC capital, companies founded only by women received 2.2%, while companies with both female and male founders received 18.6%

For US female co-founded companies, in Q1 2024, there was $11.1 billion in capital invested and 835 deal counts, compared to Q2 2024, which had $8.7 billion capital invested and 817 deal counts

🚀 IPO & Exits

The IPO Market Will End 2024 On A Low Note (5 minute read)

This year is shaping up to be a quiet one for tech IPOs, with no major venture-backed companies filing to go public in August, a typically busy time for IPO preparations. Despite favorable market conditions, such as a 31% rise in the Nasdaq Composite Index over the past year and solid performances by recent IPOs, companies are holding off due to slower revenue growth rates

Whereas enterprise software firms previously saw annual growth of 40-50%, top performers now average 20-30%, leading to delays in IPO plans

While valuations have largely been adjusted post-market downturn, the slower growth rates, combined with a "wait-and-see" mentality, have discouraged companies from going public

Experts suggest the IPO market might not pick up until late 2025 or even 2026

🗞️ AI8 VENTURES HIGHLIGHT

Check Beyond Survival: Opportunities in Climate Change

It all started in 2010 after a great conference with Mr. Al Gore. I was in Mexico City attending an event where Mr. Gore presented what the climate would look like if we did not act quickly and reduce our carbon emissions. That day, Mr. Gore’s team made his “models” available for everyone to study and play with. He told me that the largest desert in the world would be what used to be Mexico, California, Nevada, Arizona, New Mexico, and Texas, all the way to the State of Mexico. He didn’t know if Mexico City would be a part of it because of its altitude. That day, we walked several miles to our dinner because of the bad news.

Your best effort is fine; we don’t need 20% of the people doing everything right. We need 80% of the people doing their

Introducing: Climate Resilience Technology

Alpha Impact 8 Ventures is pleased to announce that we are adding a third investment vertical to our thesis: Climate Resilience Technology.

Climate Resilience Technology encompasses digital solutions designed to help communities, businesses, and ecosystems adapt to and recover from the impacts of climate change. We're looking for scalable technologies addressing existing problems caused by climate change.

Our focus areas include:

AgFinancing: Integrating advanced technologies and tailored financing solutions to improve access to capital for agricultural growth and trade, enhance food security, boost productivity, predict disruptions, and optimize logistics.

Water Management Systems: Utilizing advanced technologies and financing solutions to address water scarcity and inefficient water use exacerbated by climate change.

Energy Management and Optimization: Implementing advanced technologies and financing solutions to tackle increased energy demand and grid instability due to extreme weather conditions. This includes smart grids, microgrids, energy management software, and demand response systems that optimize energy use, integrate renewable energy sources, and enhance grid resilience.

Data, Analytics, and Predictions: Companies that utilize data and advanced analytics to predict and mitigate disruptions and climate-related events. These solutions provide crucial insights and foresight, helping communities and businesses to prepare and respond effectively to climate challenges. Advanced technologies and artificial Intelligence to enhance supply chain visibility, predict disruptions, and optimize logistics ensure continuity and efficiency.

Alpha Impact 8 Ventures is disrupting the industry, generating wealth, creating technology, providing access, leveling the play field, reducing systemic barriers, and building a resilient world.

Become part of the our revolution.

Happy reading,

AI8 Ventures’ Research & Investment Team