- AlphaInsights by Alpha Impact 8 Ventures

- Posts

- Liquidity in today’s market 💧💵💰

Liquidity in today’s market 💧💵💰

Week of October 14th, 2024

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

🦄 STARTUPS

ROUNDS AND UNICORNS

Form Energy (Renewable Energy): known for its multiday energy storage systems, the company raised a $405 million Series F led by T. Rowe Price

City Therapeutics (Biotech): This new biotech firm launched with a $135 million Series A, led by Arch Venture Partners. The company focuses on RNAi therapeutics for various diseases

EvenUp (Legal Tech): Also raising $135 million in a Series D led by Bain Capital Ventures, EvenUp provides AI-powered solutions for the personal injury sector. The startup has raised a total of $235 million and is valued at over $1 billion

AtVenu (Event Management): raised $130 million from Sixth Street. The company offers software for managing retail sales at live events, bringing its total funding to $161 million

Maven Clinic (Healthcare): raised $125 million in a Series F led by StepStone Group, bringing its valuation to $1.7 billion. Maven focuses on clinical support for preconception, family building, and other health-related areas

INDUSTRY

In Q3, global startup funding slowed, yet key investors ramped up their activity. Y Combinator, Andreessen Horowitz, and General Catalyst were standout post-seed investors, with Y Combinator increasing its deal count by backing AI firms like Encord and Leya

While the top seed-stage investors —Techstars, Y Combinator, and Antler— saw a decline in deals, their rankings remained unchanged

Notably, U.S.-based investors dominate the landscape, especially in high-value rounds, driven largely by AI investments

Market Map: VCs bet on data infrastructure to keep fueling AI (5 minute read)

Data infrastructure startups are gaining significant attention from investors as the demand for data-driven solutions grows, particularly in support of generative AI technologies. VC funding for data analytics is projected to exceed last year's total, with $20.7 billion invested in the first half of 2024, highlighted by major deals like CoreWeave's $1.1 billion Series C

PE investment in data centers has also surged, totaling $107.7 billion over the past four years

Exits are showing signs of recovery, generating $16.3 billion in the first half of 2024, with Databricks’ $1 billion acquisition of Tabular being the largest M&A deal in the sector this year

Despite a decline in overall venture capital funding, AI startups saw a significant influx of investment, raising $11.8 billion in Q3 2024, which accounted for 30% of total VC funding. This growth occurred amid challenges like increased export restrictions on AI chips and valuation uncertainties

While the number of deals dropped by 28% YoY, from 110 to 79 transactions, the funding amount remains close to previous quarterly levels, excluding a record $29.6 billion in Q2 2024

Notable investments include OpenAI's recent $6.6 billion round, pushing cumulative funding in the AI sector to over $241 billion

U.S. companies receive nearly 65% of the total amount invested

INDUSTRY WORLDWIDE

LatAm Startup Funding Sees A Modest Uptick (5 minute read)

Funding for Latin American startups has stabilized in recent quarters, reaching $884 million in Q3, a 14% increase from the previous quarter and year. However, this is still less than a quarter of the peak levels seen in early 2022. While seed and early-stage round counts declined slightly, late-stage investments rose

Fintech remained a major sector, though its dominance has decreased, with notable deals including $212 million for Mexico's Stori and $86 million for One Car Now

Overall, while Q3 did not show a significant boost, it was an improvement over Q2 and Q1, indicating a positive trend

Asia Venture Funding Hits 10-Year Low In Q3 (5 minute read)

Venture funding in Asia has hit a nearly decade-low, totaling $13.2 billion in Q3, a 13% decline from Q2 and a 44% drop from $23.8 billion last year. Deal flow also fell, with 1,509 deals announced, down 8% from Q2 and 23% from last year. Late-stage funding was particularly hard hit, totaling $5.8 billion—down 30% from Q2 and 62% from last year’s $15.3 billion

Early-stage funding saw a slight increase to $5.6 billion, a 12% rise from Q2 but still a 17% drop from the previous year

Seed rounds totaled $1.8 billion, a slight annual increase but down 9% from Q2

Despite a global drop in venture funding, Asia’s decline is sharper, particularly in AI funding, which constituted only 16% of the region's total in Q3 compared to 28% globally

Europe takes the lead: New ranking reveals surprising shift in the global venture capital landscape (3 minute read)

The venture capital landscape, historically dominated by U.S. firms, is undergoing a significant shift. For the first time, a European firm, Luxembourg-based Earlybird Digital East Fund, has topped the list. This marks a pivotal moment for European venture capital, with non-U.S. firms filling nine of the top ten spots

The study, which analyzed firms that raised over $100 million between 2010 and 2019, indicates that Europe’s tech scene has evolved dramatically, doubling active investors from 2019 to 2022

Other top firms include Australia’s Blackbird and Hong Kong’s MindWorks Capital, emphasizing the international nature of venture capital today

🏦 ECONOMIC SNAPSHOT

The September jobs report exceeded expectations, reinforcing a trend of surprising U.S. economic growth. In response to the report, the S&P 500 initially rallied nearly 1% but later declined by about 1% last week, reflecting uncertainty about the implications of sustained economic strength

The 10-year Treasury yield rose by about 20 basis points to breach 4% for the first time since August, indicating a shift in expectations regarding Fed interest rate cuts

While strong economic data is generally seen as good for stocks, there are concerns that rising yields and commodity prices could pressure stock performance

Inflation rate hit 2.4% in September, topping expectations; jobless claims highest since August 2023 (4 minute read)

In September, inflation rates exceeded forecasts, with the Consumer Price Index (CPI) rising 0.2% for the month and the annual inflation rate reaching 2.4%, both 0.1 percentage point above expectations. This marks the lowest annual rate since February 2021, despite a 0.1 percentage point decrease from August

Jobless claims unexpectedly jumped to a 14-month high, reaching 258,000 for the week ending October 5, partly due to Hurricane Helene and a Boeing strike

Inflation was driven primarily by a 0.4% increase in food prices and a 0.2% rise in shelter costs, offsetting a 1.9% decline in energy prices

The Fed has begun lowering interest rates, with expectations for a quarter-point cut at the upcoming November meeting rising to about 86%

The Biggest U.S. Stock Market Crashes Since 1970 (2 minute read)

The U.S. stock market has experienced significant declines during major financial crises. The most severe drop occurred during the global financial crisis, when the S&P 500 lost over 50% of its value, with Citigroup and AIG's stock prices plummeting more than 90% due to subprime loan exposure. The crisis followed a period of overleveraging in the housing market, leading to 3.1 million foreclosures in 2008

The second-largest crash was the bursting of the dot-com bubble, where the S&P 500 fell 49%

In the early 1980s, the Federal Reserve, under Chairman Paul Volcker, raised the federal funds rate to over 19% to combat high inflation, resulting in economic contractions but relatively mild stock market drawdowns

The 1980s eventually became one of the best-performing decades for the S&P 500, with a total increase of 232%

🌱🌎 Impact & Climate Resilience

The ‘huge disadvantage’ women behind femtech phenomenon face (4 minute read)

Despite its growth —valued at $28 billion and projected to reach $60 billion by 2027— femtech faces significant challenges. Investment in femtech remains low, with only 1-2% of health tech funding directed to this sector. Female founders often encounter gender bias, making it difficult to secure funding and market products

Censorship of women’s health content online is rampant, with a survey showing 100% of responding femtech companies experienced issues, including denied bank accounts and excessive scrutiny

Despite these obstacles, female entrepreneurs are advocating for change and support, particularly in the UK, which has a thriving femtech scene bolstered by government funding and innovation networks

2024 State of Women’s Small Business Report by Block Advisors Reveals Resilience Despite Persistent Support Barriers (15 minute read)

Block Advisors by H&R Block has released its 2024 State of Women’s Small Business Report, highlighting ongoing funding and support gaps faced by women entrepreneurs, especially black, Indigenous, and people of color (BIPOC) women. While 94% of the 6,333 surveyed applicants feel optimistic about 2025, 56% report inflation impacts on pricing, and 44% may need to cut expenses

80% cite a lack of start-up capital as a major barrier

42% of loan applicants were denied, rising to 47% for Black women

98% are motivated by community improvement, while 66% seek start-up capital and 45% marketing support

🚀 IPO & Exits

More startups are exiting at a loss than at any point since 2009 (2 minute read)

The current closed IPO market has pressured venture capitalists to seek any available liquidity, leading to a significant increase in exits where investors receive less than their original investment. Since 2022, 70% of VC-backed exits were valued below the initial capital, up from 58% between 2009 and 2014

Early-stage startups face higher loss rates, with prominent firms like Andreessen Horowitz reporting that 25% of their investments fail completely

Even later-stage investments are suffering; among companies that raised a Series D and beyond, a majority of exits since 2022 have resulted in losses

Meanwhile, M&A multiples have remained 15% to 20% lower than 2021 rates, indicating a potential stabilization in valuations

Interest Rates And The Search For Liquidity In Venture Capital (5 minute read)

Rising interest rates have negatively affected venture capital outcomes by increasing borrowing costs for private equity acquisitions, which has stifled the M&A market—the main source of exits for venture investors. This has led to fewer exits and distributions to limited partners, causing them to reduce reinvestments in new funds

Analyzing the correlation between interest rates and venture exits over the past 20 years shows that 10-Year U.S. Treasury yields are inversely related to exit volumes

Specifically, the correlation coefficient is -0.577 for U.S. Tech IPOs and -0.670 for U.S. M&A values, indicating that higher interest rates correspond with lower exit volumes

There are signs of a reopening IPO market, and anecdotal evidence suggests a resurgence in private equity and corporate M&A activity

Enterprise SaaS M&A Quarterly Update (15 minute read)

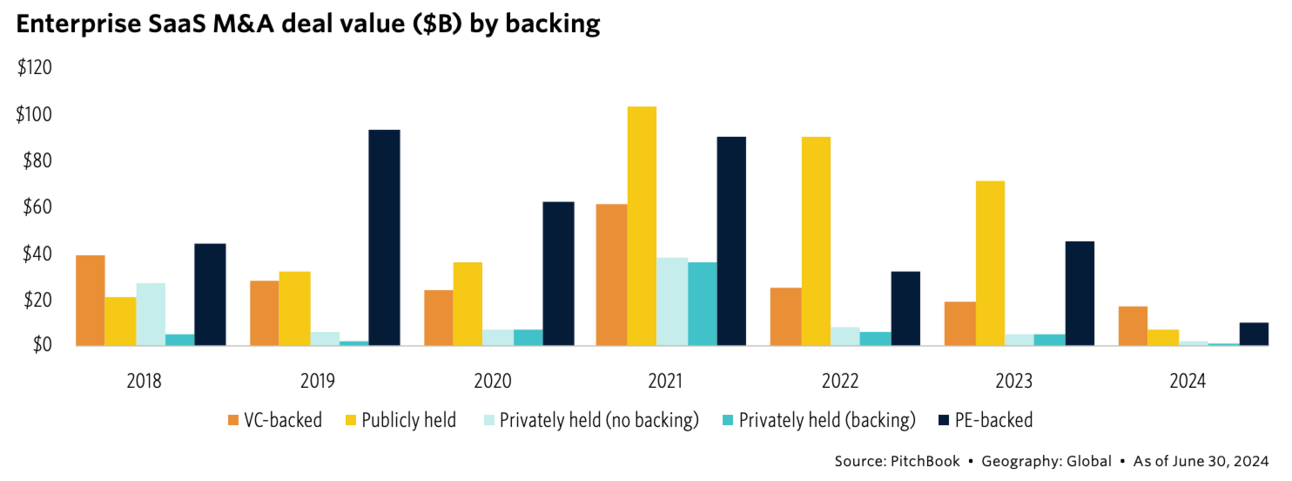

In H1 2024, VC-backed firms dominated enterprise M&A activity, with deal values reaching $17.7 billion—an 80.8% increase from the previous year. This starkly contrasts with declines in other categories: privately held (backing) deals fell 81.1%, publicly held deals decreased by 79.1%, and PE-backed deals were down 55.9%

Overall, the enterprise M&A market is projected to drop 48.3% year-over-year, from $145.9 billion in 2023

VC-backed companies accounted for 156 transactions, representing 62.2% of total M&A deals, averaging $113.3 million each

In comparison, PE-backed deals totaled $9.9 billion over 34 transactions (averaging $292.3 million), while publicly held firms accounted for $7.4 billion across 23 deals (averaging $322.5 million)

🗞️ AI8 VENTURES HIGHLIGHT

Alpha Showcase 2024: Thank you Mexico City!

What an incredible experience at the NAA International Symposium and Startup Pitching Competition!

On September 25th, we hosted the Startup Pitching Competition for the NAA’s first-ever International Symposium in Mexico City. The event featured four exceptional early-stage startups, each selected through a rigorous process, showcasing their energy and innovative ideas to an audience of over 100 allocators and industry leaders.

A huge shoutout to Yoel Gavlovski and the entire Quash team, congratulations on your well-deserved victory! The competition was fierce, and every participant truly brought their A-game to the pitches. Thank you all for making this such a memorable event!

About the NAA: Founded in 1999, the New America Alliance is dedicated to advancing the economic development of the American Latino community. We believe that Latino business leaders have a special responsibility to lead the way in building the forms of capital crucial to Latino progress – economic, political, human, and philanthropic. Through coordinated philanthropy and strategic public and private collaboration, we aim to drive investment in our community.

Alpha Insights: 2024 Venture Capital Report

Alpha Impact 8 Ventures is thrilled to share our latest insights into the dynamic world of investments with our 2024 Venture Capital Report.

Last year, Michael Burry, the legendary fund manager who famously profited from shorting the US housing market in 2008, bet more than $1.6 billion on a Wall Street crash by shorting the S&P 500 and Nasdaq-100. Nothing happened.

This year, Warren Buffett’s cash reserves reached a record $276.9 billion as Berkshire Hathaway trimmed its stock holdings in Apple. Some view it as a routine adjustment, while others speculate that Buffett perceives an overheated, overvalued market.

Everyone talks about a soft landing, but warning signs are flashing and the world seems to be teetering on a delicate balance. Is there something we’re missing? Is there an unseen factor at play?

Check Beyond Survival: Opportunities in Climate Change

It all started in 2010 after a great conference with Mr. Al Gore. I was in Mexico City attending an event where Mr. Gore presented what the climate would look like if we did not act quickly and reduce our carbon emissions. That day, Mr. Gore’s team made his “models” available for everyone to study and play with. He told me that the largest desert in the world would be what used to be Mexico, California, Nevada, Arizona, New Mexico, and Texas, all the way to the State of Mexico. He didn’t know if Mexico City would be a part of it because of its altitude. That day, we walked several miles to our dinner because of the bad news.

Your best effort is fine; we don’t need 20% of the people doing everything right. We need 80% of the people doing their best

Introducing: Climate Resilience Technology

Alpha Impact 8 Ventures is pleased to announce that we are adding a third investment vertical to our thesis: Climate Resilience Technology.

Climate Resilience Technology encompasses digital solutions designed to help communities, businesses, and ecosystems adapt to and recover from the impacts of climate change. We're looking for scalable technologies addressing existing problems caused by climate change.

Our focus areas include:

AgFinancing: Integrating advanced technologies and tailored financing solutions to improve access to capital for agricultural growth and trade, enhance food security, boost productivity, predict disruptions, and optimize logistics.

Water Management Systems: Utilizing advanced technologies and financing solutions to address water scarcity and inefficient water use exacerbated by climate change.

Energy Management and Optimization: Implementing advanced technologies and financing solutions to tackle increased energy demand and grid instability due to extreme weather conditions. This includes smart grids, microgrids, energy management software, and demand response systems that optimize energy use, integrate renewable energy sources, and enhance grid resilience.

Data, Analytics, and Predictions: Companies that utilize data and advanced analytics to predict and mitigate disruptions and climate-related events. These solutions provide crucial insights and foresight, helping communities and businesses to prepare and respond effectively to climate challenges. Advanced technologies and artificial Intelligence to enhance supply chain visibility, predict disruptions, and optimize logistics ensure continuity and efficiency.

Alpha Impact 8 Ventures is disrupting the industry, generating wealth, creating technology, providing access, leveling the play field, reducing systemic barriers, and building a resilient world.

Become part of the our revolution.

Happy reading,

AI8 Ventures’ Research & Investment Team