- AlphaInsights by Alpha Impact 8 Ventures

- Posts

- Attention: massive venture-backed startups shut down 🚨📉

Attention: massive venture-backed startups shut down 🚨📉

Week of January 29th, 2024

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We've scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

🦄 STARTUPS

ROUNDS AND UNICORNS

Recurrent Energy, a utility-scale solar and energy storage project developer, secured a $500 million preferred equity investment from BlackRock to grow its project development pipeline

Bilt Rewards raised $200 million in a round led by General Catalyst, valuing the New York-based loyalty rewards startup at $3.1 billion. Bilt plans to expand its network to include various retail purchases and has appointed industry heavyweights as chairman and independent director

BillingPlatform, a fintech company providing a revenue lifecycle management platform, raised $90 million in a round led by FTV Capital, aimed at enhancing its platform for increasing revenue streams

ElevenLabs, a voice AI startup, raised an $80 million Series B at unicorn valuation for its AI software that replicates voices in multiple languages. The round was co-led by Andreessen Horowitz, Nat Friedman, and Daniel Gross

Accent Therapeutics, a biopharmaceutical company, raised $75 million in a Series C led by Mirae Asset Capital Life Science, focusing on small molecule precision cancer therapies for breast and colorectal cancers

2024: A Year Of Reckoning And Resilience For Startups And VCs (4 minute read)

In 2024, the private markets face challenges and opportunities following a tumultuous 2023. Factors such as a global economic slowdown, higher interest rates, and increased venture capitalist conservatism are expected to test the resilience of startups

Oversupply of capital in 2023 led to inflated valuations, resulting in the shutdown of over 3,200 venture-backed startups

Investment banks are anticipated to experience a resurgence in 2024, driven by an acceleration of mergers and acquisitions as private companies face financial challenges

The IPO market is expected to open with companies like Databricks and Stripe, along with a pipeline of over 400 companies eager to access public markets

The venture capital landscape will see a shift in power to limited partners (LPs) as numerous venture funds may face demise due to a lack of exits and increased company shutdowns

In the aftermath of the 2021 venture funding peak and subsequent pullback, seed funding for startups has evolved into its own asset class, with larger round sizes and a growing pool of investors. While seed funding has proven more resilient than other startup investment stages, the aftermath of the boom has led to challenges for very young startups, with lower valuations and higher expectations to secure backing:

Seed round valuations have not experienced a substantial drop, but the bar for raising seed funding has significantly increased. Also, series A funding has become more challenging as companies go through multiple seed rounds

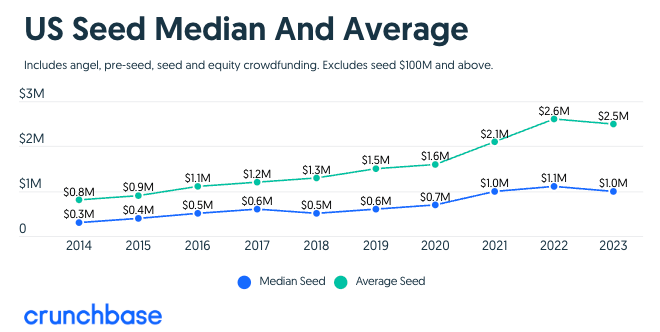

Median and average seed round sizes in the U.S. have climbed over the past decade, with 2023 figures not far from the peak of 2022. Larger seed rounds, particularly those above $1 million, have become more prevalent, while seed rounds below $1 million represent a smaller proportion of overall seed funding

The seed phase has become a crucial and elongated stage in a company's early life cycle, characterized by multiple million-dollar seed rounds

There's a shift in the proportion of seed funding below $1 million, which has declined over the past decade. As more companies engage in the seed pool, the expectations for Series A funding to pick up in 2024 are discussed

US Seed Investment Actually Held Up Pretty Well For The Past 2 Years. Here’s What That Means For 2024 (4 minute read)

Despite a global pullback in startup investment over the past two years, U.S. seed funding has remained more vibrant compared to other funding stages during the downturn. In 2023, U.S. seed funding experienced a 31% decline, which, though significant, was still less than the year-over-year declines seen in other funding stages

The U.S. seed funding environment remained robust, with funding still $2 billion to $3 billion higher than pre-pandemic levels in 2019 and 2020

Seed funding as an asset class has grown over the past decade, reaching over $16 billion at the market peak in 2022 before falling to $11.5 billion in 2023

Investors acknowledge being more selective in funding companies and adopting a disciplined approach due to the challenges in reaching Series A and beyond

The median time between a $1 million-plus seed and a Series A has increased over the decade, with companies taking longer to execute and de-risk. The typical time in 2023 jumped to 28 months, reflecting a trend of companies raising Series A at a more mature stage

INDUSTRY

Fintech: State of the Industry (40 minute read)

The fintech sector, after a post-COVID-19 boom, is undergoing a normalization phase. In 2023, fintech venture capital recorded $34.6 billion, marking a -43.8% year-over-year (YoY) decline. The capital focus has shifted toward B2B, constituting 72.1% of total fintech VC, compared to 40.6% in 2019

In 2023, VC exit value reached $5.9 billion across 185 exits, reflecting YoY declines of -76.1% and -22.3%, respectively

M&A activity also declined by -33.6% YoY to $47.1 billion. Despite this, late 2023 M&A activity hints at a potential uptick in 2024, with some fintech companies preparing for public exits, potentially revitalizing the IPO market

Regulations continue to shape innovation, impacting generative AI, open banking, third-party relationship management, and nonbank compliance, prompting industry players to upgrade infrastructure and risk-management capabilities

In 2023, fintech venture capital recorded $34.6 billion, showing a -43.8% drop from 2022's $61.4 billion. This decline is attributed to a normalization of deal levels from the exceptionally high figures in 2021 and 2022, driven by federal stimulus, low-interest-rate policies, and strong investor demand

OpenAI and Other Tech Giants Will Have to Warn the US Government When They Start New AI Projects (5 minute read)

The Biden administration plans to use the Defense Production Act to compel tech companies, including OpenAI, Google, and Amazon, to inform the government when training large language models using significant computing power

This move aims to provide the US government with advance notice of breakthroughs in AI, specifically large language models like ChatGPT

The new rule requires companies to share information about the computing power used, data ownership, and safety testing for AI models

The decision comes as part of a broader executive order issued in October, with the Commerce Department set to define reporting requirements

Some experts argue for government oversight amid concerns about the powerful capabilities of AI models, while others stress the need for comprehensive AI regulation

The Commerce Department is also working on guidelines for AI safety testing standards through the National Institutes of Standards and Technology

🏦 ECONOMIC SNAPSHOT

US economic growth ends 2023 with surprising strength (3 minute read)

In the last quarter of 2023, the US economic growth rate slowed to 3.3%, down from the previous quarter's 4.9% but surpassing economists' expectations of 2%. The resilience of the economy is evident in robust consumer spending and government outlays, contributing to growth

The Federal Reserve's efforts to curb inflation by raising rates to a 22-year high seem to be achieving a "soft landing," as unemployment remains low, and the economy weathers the rate hikes without a significant slowdown

Despite concerns, the US economy is still projected to experience slow growth in 2024, but a recession is not yet considered imminent

Consumer sentiment has shown signs of improvement, with optimism driven by confidence in easing inflation and strengthening income expectations

Fed Rate Decision Could Be the Prelude to a March Cut (4 minute read)

Investors are speculating about the possibility of the Federal Reserve cutting interest rates in the upcoming policy meeting, with around even odds for a rate cut in March. The decision hinges on how Fed Chair Jerome Powell interprets recent economic data, where inflation is slowing but consumer spending remains robust

Meanwhile, in the global economy, attention is on central bank decisions in the UK, Sweden, and Latin America, as well as economic data releases in Europe and Asia

In Latin America, the central banks of Brazil and Colombia are expected to cut rates, while Chile may lower rates by 100 basis points

As of early 2024, the financial landscape is characterized by high-interest rates, impacting various sectors differently. The Federal Funds rate stands at 5.25% to 5.50%, reflecting the Federal Reserve's strategy to control inflation, which peaked at 9.1% in June 2022. The impacts of rising interest rates include increased borrowing costs, potentially slowing economic growth, and affecting corporate profits

Sectors respond differently; financials, energy, healthcare, and utilities are explored as potential beneficiaries during high-interest rate environments:

Financials: generally experiences increased profitability as interest income from loans rises faster than interest paid on deposits. However, higher rates can impact loan demand and consumer borrowing

Energy: profits can be influenced by increased cost of capital, but essential nature of energy products maintains demand

Healthcare: Healthcare services and products are considered necessities, leading to consistent demand even during economic fluctuations. Larger companies with strong financial foundations can withstand rising interest rates better

Utilities: faces challenges as a capital-intensive industry reliant on debt financing. Stocks may become less attractive to investors seeking higher-yielding fixed-income investments. However, the sector's essential services maintain relatively constant demand

🧑🏿🤝🧑🏽 IMPACT & DIVERSITY

Women-led funds’ share of total fundraising increases substantially, representing about 3% of the $107 billion raised last year by venture funds worldwide, up from 1.3% of $166 billion raised in 2022. Some female GPs attribute this positive spin in LPs realizing the real outperformance women-led funds deliver and are doubling down on their investments into these GPs

86 women-led funds held partial or final closes, raising about $3.5 billion combined last year, or roughly $500 million more than they raised a year earlier

The average size of all VC funds raised in 2023 was $244 million, more than four times the average of women-led funds raised since the beginning of 2022

🚀 IPOs

Rough Ride: M&A Dropped 31% For VC-Backed Startups In 2023 (3 minute read)

In 2023, dealmaking involving venture-backed startups reached an eight-year low globally, with only 1,738 acquisitions, a 31% decline from 2022. The U.S. market also experienced a 10-year low, with only 824 deals completed, a 30% drop from the previous year

This lack of dealmaking poses challenges for venture capitalists, as mergers and acquisitions serve as a primary way to gain liquidity from their investments

Despite the pessimism, some experts predict a potential rebound in dealmaking within the next three to nine months as valuations continue to drop

Public companies, particularly in sectors like AI, are anticipated to invest, leading to increased activity in 2024, with sectors such as cyber, crypto, semiconductors, and AI driving potential improvements

Many Boom Time Startup Acquisitions Have Worked Out Badly (4 minute read)

Crunchbase highlights examples of high-profile acquisitions of venture-backed companies that didn't work out as hoped. These cases demonstrate that even in successful companies, certain acquisitions might not yield the expected benefits, some examples include:

Shopify-Deliverr: Shopify's $2.1 billion acquisition of Deliverr in 2022 faced challenges, with Shopify later disclosing layoffs and the sale of its logistics business, including Deliverr, at a fraction of the purchase price

JP Morgan-Frank: JPMorgan Chase's $175 million acquisition of Frank Financial Aid in 2021 resulted in a lawsuit, with JPMorgan accusing the startup of lying about its size and market penetration. Frank's website is no longer operational, and its founder faces fraud charges

Uber-Drizly: Uber's $1.1 billion acquisition of Drizly in 2021 saw the alcohol delivery service being shut down, raising questions about the value derived from the deal

While not all acquisitions work out, successful deals can deliver extraordinary returns. However, increased antitrust scrutiny and regulatory challenges have contributed to a slowdown in M&A activity involving venture-backed companies

Global M&A Report (40 minute read)

In 2023, the global M&A market experienced its second weakest year in a decade, with the total value of deals closed or announced reaching $3 trillion, a 15.8% decrease from 2022. Despite the decline, the rate of decrease appears to be slowing, showing signs of recovery

2023 witnessed over 40,200 M&A deals, ranking as the third-highest total on record, even though the dollar volumes were the weakest since 2013, excluding the global lockdown of 2020

Since the peak in 2021, global M&A value has declined by 35.5%. There is speculation among M&A professionals about whether the current down cycle will extend for another year. However, analysts do not anticipate a prolonged downturn similar to the 2007 global financial crisis, which saw a 60.0% decline in deal value before bottoming in 2009

In the fourth quarter of 2023, North America's M&A landscape showed a mixed picture amid ongoing macroeconomic challenges: the region experienced a notable increase in total M&A value, reaching $497.1 billion, marking a robust 17.8% year-over-year increase and an even more substantial 35.9% quarter-over-quarter surge. However, the volume of deals presented a contrasting trend, with 4,043 deals recorded, reflecting a 6.6% Year over Year decrease and a slight 0.9% Quarter over Quarter dip

🗞️ AI8 VENTURES HIGHLIGHT

One of our portfolio companies, MPOWER Financing, is recruiting a head of LATAM Business Development. Ideally, a mid-career candidate with a ton of firepower (e.g., management consulting, I-banking, or big tech background), a firm dedication to MPOWER's mission (global citizens focused on removing barriers to education by providing access to much-needed financing, ideally studied in N. America herself / himself), an obsession with data (analytical to a fault), and a strong drive for closing deals.Full Job Description and link to apply: https://lnkd.in/ggX5RVYU

Alpha Impact 8 Ventures is thrilled to share our latest insights into the dynamic world of investments with our 2023 Venture Capital Report.Just a few months ago, Michael Burry, the legendary fund manager who famously profited from shorting the US housing market in 2008, bet more than $1.6 billion on a Wall Street crash by shorting the S&P 500 and Nasdaq-100. Warren Buffett’s money pile reached record highs of $157 billion as Berkshire Hathaway disposed of a net $33 billion of stocks over the past three quarters. Is there something Buffett and Burry know that the rest of us don’t?Check out the full report here

8 Wealth Creation Essentials

Fraud Alert: How to Identify and Protect Yourself from Financial Scams

While fundraising as a fund manager, I have found out that trust is not earn easily. I might have faced some biases because I am too brown, culturally different and speaks with an accent. I rely on math, strategy, processes, and performance to present our fund, moving the conversation from how I look, to what I am doing. Why should someone trust me with their money, or even worse, their clients' money? I, also expect that my counterparts do their jobs andunderstand the risk-reward profile of an investment in venture capital. Even as a top 1% performance firm with a super strict risk management strategy, less than 10% of your portfolio should be with us

Whether you're a seasoned investor, a finance professional, or simply someone keen on staying informed, this article is a must-read

If you have any comments or feedback, just respond to this email!

Happy reading,

AI8’s Research & Performance Team