- AlphaInsights by Alpha Impact 8 Ventures

- Posts

- Against all odds: U.S. Economy Grows 3% in Q2 2024 🇺🇸🔮 💰

Against all odds: U.S. Economy Grows 3% in Q2 2024 🇺🇸🔮 💰

Week of September 2nd, 2024

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

🦄 STARTUPS

ROUNDS AND UNICORNS

Magic (AI): Magic develops AI models to write software, the company raised $320 million from investors including Eric Schmidt and Sequoia. Magic has now raised $465 million in total

Cribl (Data): raised $319 million in a Series E round, with $200 million in capital and $119 million from a secondary offering. The data infrastructure company, valued at $3.5 billion, provides observability into data for IT and security teams

Codeium (AI): an AI-powered coding assistant, closed a $150 million Series C round led by General Catalyst, valuing the company at $1.25 billion

Elektrofi (Biotech): a preclinical-stage biotech startup developing new drug delivery methods, is raising approximately $112 million in a Series C

Navigator Medicines (Biotech): Scotch Plains, New Jersey-based Navigator Medicines, focused on treatments for autoimmune diseases, raised $100 million in a Series A co-led by Forbion Capital Partners and RA Capital Management

In recent years, a growing portion of U.S. startup investment has come from corporate funding rounds, with 2023 seeing a record high of 12% of total funding, driven largely by Microsoft's $10 billion investment in OpenAI. The trend continues into 2024, with corporate rounds accounting for 7.4% of total funding, notably boosted by Alphabet’s $5 billion investment in Waymo

Over the past six years, corporate funding has fluctuated, averaging around 5% of total investment

These corporate investments are often strategic, focusing on technological collaboration and competitive advantage rather than purely financial returns

Despite a quieter exit environment, corporate rounds remain significant due to the strategic benefits they offer to the investing companies

INDUSTRY

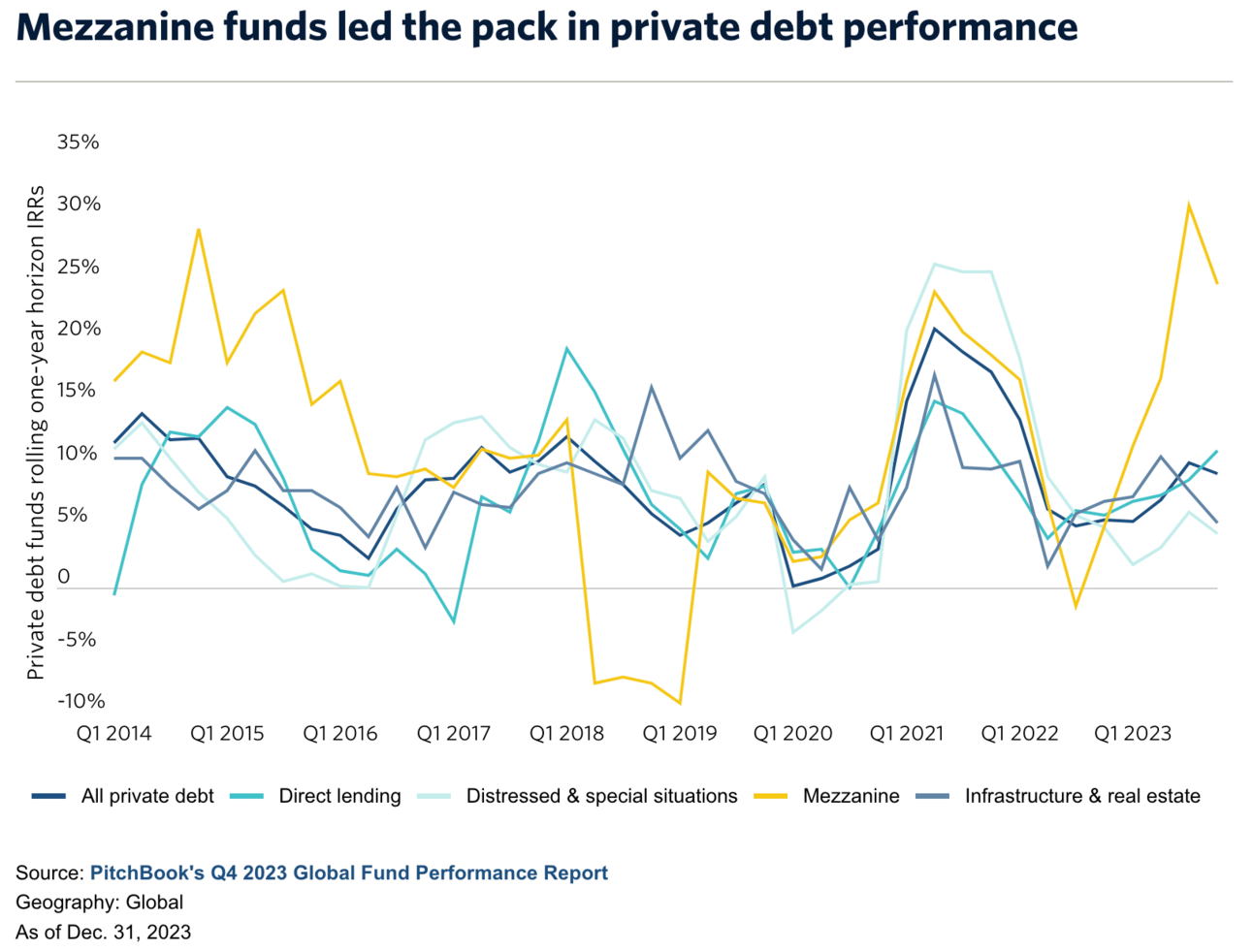

For private debt funds, the good times keep rolling (4 minute read)

Private debt funds had a standout performance in 2023, achieving a rolling one-year IRR of 9.2%, making it the second-best strategy in the private market behind private equity, which had a 10.5% return. This strong performance was driven by elevated interest rates and reduced bank lending to riskier borrowers, allowing private debt managers to secure higher coupon rates and favorable terms

LPs invested nearly $170 billion into private debt funds for the four quarters ending March 2024, marking the second-largest share of capital raised among private market funds

Within private debt, mezzanine funds led with a 24.5% IRR, while direct lending returned 11.1%

Despite this robust performance, future returns may be impacted if central banks impose significant interest rate cuts, potentially signaling a recession and affecting non-investment-grade borrowers

Putting OpenAI’s Crazy High $100B Valuation Into Context (4 minute read)

OpenAI is reportedly in talks for a new funding round at a valuation exceeding $100 billion, marking a 16% increase from its previous valuation and positioning it as one of the most valuable venture-backed companies globally, second only to SpaceX

This valuation surpasses the GDPs of 110 nations and exceeds the initial market caps of all U.S. venture-backed startups except Facebook

Despite concerns about its significant losses and $3.4 billion in annual revenue, history shows that such high valuations can sometimes be justified, making it risky to bet against OpenAI's future potential

Nvidia reported record earnings of $30.04 billion for the past quarter, a 122% increase from the previous year, driven by strong demand for its AI chips. Despite exceeding analysts' revenue expectations of $28.7 billion, Nvidia's shares fell over 3% in after-hours trading

Nvidia’s data center revenue surged 154% to $26.3 billion

However, the company announced a $50 billion stock buyback and reported earnings per share of $0.68, beating the expected $0.64

The company's stock has risen 167% over the past year and represents 6% of the S&P 500's total value

INDUSTRY WORLDWIDE

Venture Funding To China-Based Startups Dries Up (2 minute read)

Venture funding for Chinese startups is on track to hit its lowest point in a decade, with total funding plummeting to $7.4 billion in the last quarter, a 42% drop from Q1, marking the weakest performance since 2014. Early-stage funding has been particularly hard hit, falling 67% from Q1 to just $2.5 billion

While some large growth rounds occurred, they were significantly smaller compared to previous quarters

Even the AI sector, which many hoped would revitalize the market, saw a decrease in funding

Rising tensions between the U.S. and China, coupled with restrictive regulatory policies, have likely contributed to the downturn, raising concerns about the broader impact on the Asian venture ecosystem

🏦 ECONOMIC SNAPSHOT

In Q2’ 2024, the U.S. economy grew faster than initially reported, with GDP revised up to 3% from 2.8%, largely due to stronger personal spending. This growth highlights the economy's resilience despite ongoing inflation, which remains above the Federal Reserve's 2% target but is significantly lower than its pandemic-era peak

Employment conditions remain stable, with low layoffs and wages keeping pace with inflation, though consumer confidence is mixed

Stock markets reacted positively to the economic data, and although the Fed is expected to cut interest rates, the likelihood of a significant reduction is decreasing

The third-quarter GDP is estimated to grow around 2%, suggesting continued economic expansion

Is A Recession Coming For The U.S. Economy? (2 minute read)

While a 2024 recession is generally considered unlikely, two key indicators—the Sahm Rule and the yield curve— suggest that a recession could occur, possibly in 2025. Market forecasts, like Kalshi, estimate only a 9% chance of recession in 2024, while J.P. Morgan puts it at 1 in 3, citing labor market risks and manufacturing softness. However, financial markets, with the S&P 500 rebounding close to its recent high, do not seem to anticipate an imminent recession

The Sahm Rule indicates that rising unemployment, which reached 4.3% in July 2024 from 3.5% a year earlier, could foreshadow a recession

Meanwhile, the yield curve, which has been signaling a recession for two years, currently suggests a 50% chance of a recession in the next 12 months according to the New York Federal Reserve

Despite these signals, a 2024 recession is improbable given the positive growth in the first half of the year

The upcoming jobs report on September 6 will be closely watched as unemployment trends could influence the economy's trajectory

The U.S. jobs report expected on September 6 is anticipated to show a net gain of 175,000 jobs and an unemployment rate of 4.2%. Average hourly earnings are projected to increase by 0.3% month-over-month, with a year-over-year gain cooling slightly to 3.5%. Key areas for hiring recovery include private education, health care, and leisure and hospitality

Following a mild increase in July and a rise in the unemployment rate to 4.3%, focus will be on whether seasonal distortions from July persist or if the data aligns with recent averages

If the report reveals weaker hiring and rising unemployment, with increased jobless claims and deteriorating job openings, the Fed might consider a 50-basis point rate cut

However, a 25-basis point cut is more likely in September, with further reductions expected until the policy rate reaches around 3.25%

🌱🌎 Impact & Climate Resilience

The Global Water Challenge: Risks And Opportunities That All Investors Should Consider (10 minute read)

With over 50% of cities and 75% of irrigated agricultural areas experiencing recurring water shortages, and water-related disasters causing 70% of natural disaster-related fatalities and over $200 million in daily economic loss, Manulife Investment Management recognizes the critical need for robust water governance and management

Advances in water technologies, such as precision irrigation and water recycling, offer potential for improving water efficiency and creating value

The focus on water-related natural capital accounting and nature-based solutions also represents a burgeoning area for investment, aiming to address water scarcity while generating financial returns

The Corporate Retreat From DEI: A Short-Sighted Strategy? (2 minute read)

Recently, some companies, including Ford, Lowe’s, and Harley-Davidson, have scaled back their Diversity, Equity, and Inclusion (DEI) initiatives due to economic concerns, political backlash, and societal criticism. This retreat raises concerns about overlooking the long-term benefits of DEI, which include enhanced decision-making, increased innovation, and higher employee satisfaction

Research shows that diverse companies often outperform their peers, with studies indicating a 25% higher profitability for gender-diverse executive teams and a 19% increase in revenue from innovation in companies with diverse management teams

Scaling back DEI efforts may save money short-term but risks damaging reputation, alienating customers, and losing top talent

🚀 IPO & Exits

To Make It Big, Most Tech Startups Have A Limited Post-IPO Window To Turn Profitable (2 minute read)

Most tech startups that go public do so before turning a profit, with some exceptions like Google, Instacart, and Klaviyo. It's common for investors to wait several years for these companies to become profitable, as seen with Uber (5 years post-IPO), Palo Alto Networks (6 years post-IPO), and Shopify (5 years post-IPO)

Some companies, like Tesla (10 years post-IPO) and Salesforce (13 years post-IPO), took even longer to achieve profitability but maintained high valuations due to strong brand recognition and investor confidence in their business models

High revenue growth can make ongoing losses more tolerable, as demonstrated by Amazon (26 years post-IPO)

As a large backlog of private tech unicorns remains unprofitable, these companies may need to convince investors of their potential to turn a profit in the coming years to succeed in the public markets

VC investors are optimistic that gaming companies could boost the IPO market, with deal activity in the sector gaining momentum. In Q2 2024, gaming companies raised $1.8 billion across 136 deals, according to PitchBook’s Q2 2024 Gaming Report

Notable acquisitions include DraftKings' $750 million purchase of Jackpocket and The Carlyle Group's $1.1 billion sale of Jagex to CVC Capital Partners and Haveli Investments

As market conditions may improve with anticipated interest rate cuts, there is hope that more gaming startups will pursue public listings

PitchBook’s has identified 10 US venture-backed gaming unicorns likely to go public, such as the popular social platform for gamers, Discord, valued at $1.6B

🗞️ AI8 VENTURES HIGHLIGHT

Check Beyond Survival: Opportunities in Climate Change

It all started in 2010 after a great conference with Mr. Al Gore. I was in Mexico City attending an event where Mr. Gore presented what the climate would look like if we did not act quickly and reduce our carbon emissions. That day, Mr. Gore’s team made his “models” available for everyone to study and play with. He told me that the largest desert in the world would be what used to be Mexico, California, Nevada, Arizona, New Mexico, and Texas, all the way to the State of Mexico. He didn’t know if Mexico City would be a part of it because of its altitude. That day, we walked several miles to our dinner because of the bad news.

Your best effort is fine; we don’t need 20% of the people doing everything right. We need 80% of the people doing their

Introducing: Climate Resilience Technology

Alpha Impact 8 Ventures is pleased to announce that we are adding a third investment vertical to our thesis: Climate Resilience Technology.

Climate Resilience Technology encompasses digital solutions designed to help communities, businesses, and ecosystems adapt to and recover from the impacts of climate change. We're looking for scalable technologies addressing existing problems caused by climate change.

Our focus areas include:

AgFinancing: Integrating advanced technologies and tailored financing solutions to improve access to capital for agricultural growth and trade, enhance food security, boost productivity, predict disruptions, and optimize logistics.

Water Management Systems: Utilizing advanced technologies and financing solutions to address water scarcity and inefficient water use exacerbated by climate change.

Energy Management and Optimization: Implementing advanced technologies and financing solutions to tackle increased energy demand and grid instability due to extreme weather conditions. This includes smart grids, microgrids, energy management software, and demand response systems that optimize energy use, integrate renewable energy sources, and enhance grid resilience.

Data, Analytics, and Predictions: Companies that utilize data and advanced analytics to predict and mitigate disruptions and climate-related events. These solutions provide crucial insights and foresight, helping communities and businesses to prepare and respond effectively to climate challenges. Advanced technologies and artificial Intelligence to enhance supply chain visibility, predict disruptions, and optimize logistics ensure continuity and efficiency.

Alpha Impact 8 Ventures is disrupting the industry, generating wealth, creating technology, providing access, leveling the play field, reducing systemic barriers, and building a resilient world.

Become part of the our revolution.

Happy reading,

AI8 Ventures’ Research & Investment Team