- AlphaInsights by Alpha Impact 8 Ventures

- Posts

- Will CrowdStrike-like outages be the norm? 🛫🧨

Will CrowdStrike-like outages be the norm? 🛫🧨

Week of July 23th, 2024

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

🦄 STARTUPS

ROUNDS AND UNICORNS

The Week’s Biggest Funding Rounds: Cardurion Pharmaceuticals And Human Interest Nab Largest Raises (5 minute read)

Cardurion Pharmaceuticals (biotech): raised $260 million in a Series B round led by Ascenta Capital. The company focuses on developing cardiovascular disease therapeutics

Human Interest (fintech): secured $242 million in a round led by Baillie Gifford and Marshall Wace, including $25 million in debt. The company helps small businesses offer 401(k) plans to their employees. They are now valued at $1.3

Tekion (automotive): raised $200 million in growth equity from Dragoneer Investment Group, valuing the automotive software platform provider at over $4 billion

Saronic (defense): closed a $175 million Series B at a $1 billion valuation led by Andreessen Horowitz. The company designs autonomous surface vehicles for the U.S. Navy

Scorpion Therapeutics (biotech): secured $150 million in a Series C co-led by Frazier Life Sciences and Lightspeed Venture Partners. The Boston-based precision oncology company will use the funds for developing treatments for breast cancer and other solid tumors

INDUSTRY

Unpacking how Alphabet’s rumored Wiz acquisition could affect VC (4 minute read)

Alphabet, Google's parent company, is in advanced discussions to acquire cybersecurity startup Wiz for $23 billion. If completed, this acquisition would be Alphabet's largest to date and a significant exit for a startup, especially in a sluggish M&A market

Despite a slow first half of 2024 with only 356 startup acquisitions in the U.S., this deal, due to its size, might inspire more activity but won't solve the liquidity crunch faced by large late-stage startups

The deal could also positively impact venture fundraising, offering some relief to hesitant LPs and potentially shortening exit timelines

If Wiz is acquired, it might prompt VCs to resume funding, with notable pitch deck activity already observed. However, actual deal closures haven't significantly increased yet

These startups are trying to prevent another CrowdStrike-like outage, according to VCs (5 minute read)

On Friday 19th, a faulty software update from CrowdStrike led to widespread "blue screens of death" for Windows users, causing significant disruptions to airlines, hospitals, and banks. This incident highlights the heavy reliance on technological infrastructure and has prompted some venture capitalists to view it as an opportunity for innovation

CRV’s GP, Reid Christian argues that the real issue was not cybersecurity but “inadequate testing and deployment of software updates”

Though this was not a cybersecurity attack, the severity of the disruption—due to CrowdStrike’s deep access to the Windows kernel—has spurred interest in alternatives like non-invasive security solutions

The outage has highlighted the growing need for cloud observability and API integration solutions

Tough times for VC newcomers as larger funds dominate (4 minute read)

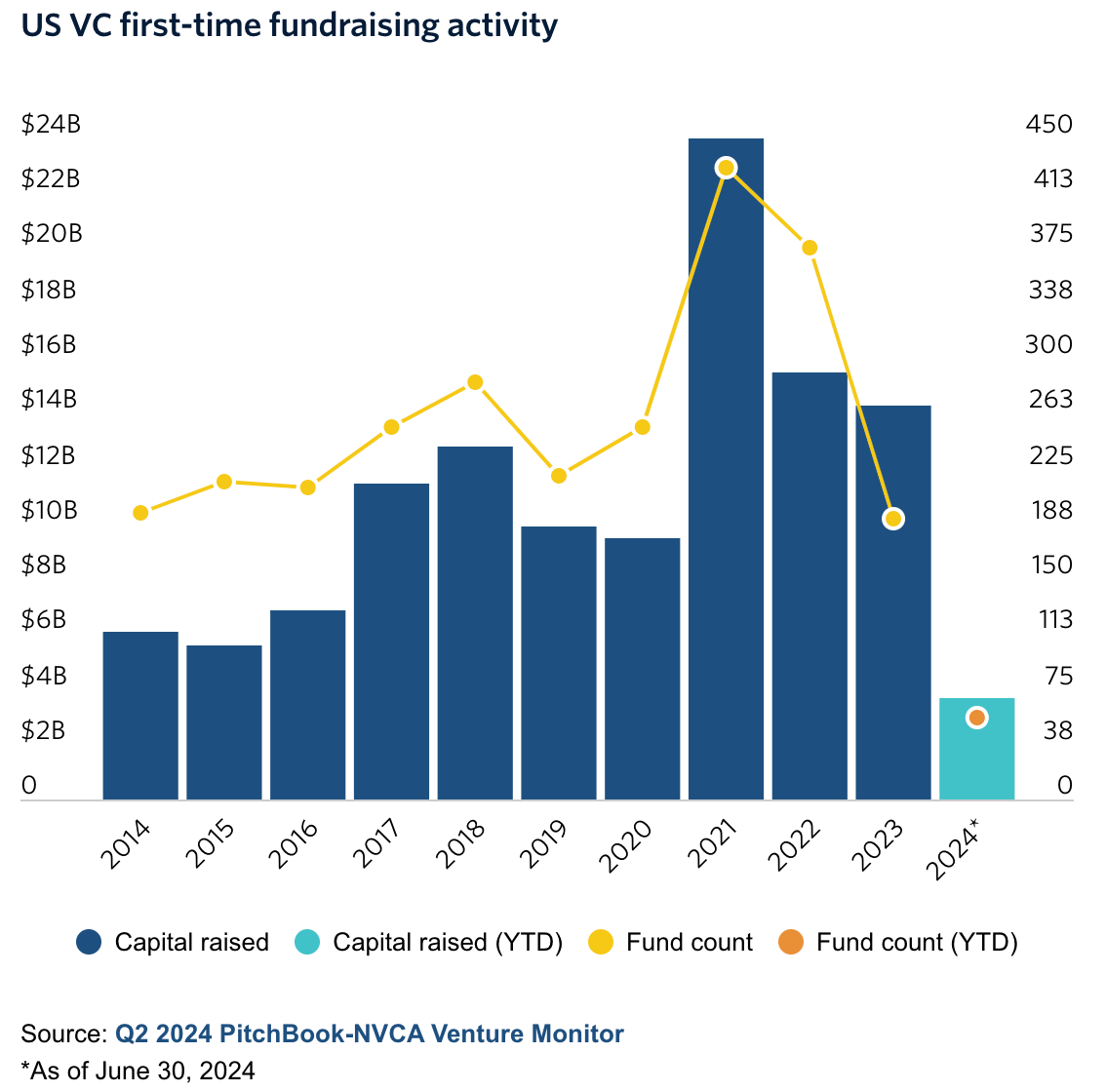

Global VC fundraising is set for its worst year since 2015, with emerging managers—those who have launched fewer than four funds—raising less capital than ever before. In the first half of 2024, VCs closed 632 funds, raising $80.5 billion, indicating fewer than 1,300 new funds this year, compared to the 4,000 in 2021

Emerging managers have captured only 23% of fund value year-to-date, the lowest in 10 years

In 2024, first-time fundraising activity hit a record low, with only 56 new funds raising $3.7 billion

The funding gap is widening, with larger funds over $400-$500 million dominating. Meanwhile, the median capital raised by VCs has dropped to $24.8 million, the lowest since 2016

🏦 ECONOMIC SNAPSHOT

Investors are shifting away from megacap tech stocks towards smaller companies and other sectors. The Russell 2000 small-cap index has jumped 7% since the beginning of the month, driven by falling inflation and an improving earnings outlook

In contrast, the S&P 500's "Magnificent Seven" tech stocks have fallen, impacted by a global semiconductor sell-off

Over the past week, 1,500 of the Russell 2000's nearly 2,000 companies have risen. Meanwhile, the equal-weighted S&P 500 has outperformed the cap-weighted version

The Russell 2000 fell 1.9% after data showed high jobless claims, highlighting the need for rate cuts without a major economic downturn

More Workers Are Filing for Unemployment: What to Know (4 minute read)

U.S. unemployment benefit filings rose last week to 243,000, marking the eighth consecutive week claims were above 220,000. The total number of Americans receiving benefits reached 1.87 million, the highest since November 2021

This trend aligns with the Fed’s efforts to cool the labor market to combat inflation, with an expected potential rate cut in September

Despite adding 206,000 jobs in June, the unemployment rate ticked up to 4.1%

The labor market remains strong but shows signs of softening, with job postings slightly up in May but April's figures revised down

With President Joe Biden's exit from the presidential race, the Democratic successor will face a complex economic landscape shaped by recent policies and conditions:

Interest Rates: The Fed has kept interest rates high at a 23-year peak, aiming to combat inflation. Although there have been indications that rates might ease later in the year, they remain elevated

Inflation: has improved since its peak of 9.1% in June 2022. As of last month, the annual inflation rate was 3%, down from 3.3% in May

Manufacturing Jobs: have plateaued at 13 million, with a slight decline in specific sectors like machinery manufacturing

What to Expect From This Week's Report on US Economic Growth? (4 minute read)

Despite recent signs of economic slowdown, growth likely remained stable through the second quarter. Economists forecast that GDP grew at an annualized rate of 1.9% for Q2, up from 1.3% in Q1 but slower than the 2.6% annualized growth seen in the second half of 2023

This growth rate indicates a modest expansion below the economy's potential and is consistent with the observed disinflation of 1.5% in the first half of 2024

Several factors contributed to this growth, for example, Consumer spending remained strong despite inflation and high borrowing costs

Key economic indicators include:

Record-high household wealth at $144 trillion

Real disposable income up by 3.1% YoY

🌱🌎 Impact & Climate Resilience

Nearly Half of Angel Investors Are Women, and Nearly Half of Startups Looking for Angel Investment Are Woman-Led (4 minute read)

The share of female angel investors has been increasing over the past three years. In 2023, women comprised 46.7% of the VC market, up from 39.5% in 2022 and 33.6% in 2021. Overall angel investment in U.S. startups declined from $22.3 billion in 2022 to $18.6 billion in 2023

Nonetheless, Women-led companies seeking angel funding rose to 46.3% in 2024, up from 37.1% in 2023 and 28.6% in 2021

The increase in female angel investors is also contributing to job creation, with each angel investment creating 4.3 jobs in 2023, compared to 3.4 jobs per investment in 2022

Sustainability-Focused Startup Equity Funding Fell In H1 2024 (4 minute read)

Equity funding for cleantech and sustainability startups is down significantly. The first half of 2024 saw $9.6 billion in funding, a 61% drop from 2023 and a 10% decline from 2022. However, cleantech wasn't as hard-hit as other sectors during the post-2021 downturn

Investment themes in cleantech this year include the battery supply chain, EV charging, and hydrogen energy

Notable equity rounds include Sila Nanotechnologies' $375 million Series G for next-gen battery materials, Ascend Elements' $162 million for battery recycling, and large rounds for EV charging companies like Electra and FLO

The overall decline in technology IPOs and the collapse of the SPAC market have impacted cleantech exits

Climate Tech Funds Report (15 minute read)

Specialist VC fundraising in climate tech saw a significant peak in 2022, with $18.7 billion raised—over double the $8.8 billion in 2021. This growth was driven by increasing global awareness of climate change, heightened commitments from governments and companies, and supportive regulations. However, in 2023, fundraising in climate tech declined significantly due to a tougher VC environment, reduced exit activity, particularly in low-carbon mobility, and high interest rates

The first half of 2024 shows some improvement, with $3.4 billion raised as of June 25, slightly below the $3.9 billion raised in 2023

By 2023 climate tech funds represented 1.9% of all VC funds and 2.0% of total VC capital. As of mid-2024, climate tech VC funds represent 3.0% of fund counts and 4.8% of VC fundraising activity

In the first half of 2024, 18 climate funds closed, with five surpassing $300 million, vs 2023, which saw 37 funds close, though only three exceeded $300 million

🚀 IPO

From Small Caps To Big Gains: The Promise Of Micro-Cap IPOs (4 minute read)

Traditional funding sources like venture capital and bank loans are highly competitive, pushing entrepreneurs to seek innovative funding methods. Micro-cap initial IPOs offer a notable but often overlooked alternative. A micro-cap IPO involves a company with a market capitalization between $50 million and $300 million, typically operating in niche or emerging markets

These companies, although less established and more susceptible to market volatility, can offer significant growth potential and substantial returns if they succeed

Successful examples of micro-cap IPOs include early investments in companies like Microsoft and Monster Beverage

Despite facing challenges from economic and geopolitical uncertainties, the micro-cap IPO market showed resilience in 2023, with 87 issuers raising $1.25 billion

🗞️ AI8 VENTURES HIGHLIGHT

Check Beyond Survival: Opportunities in Climate Change

It all started in 2010 after a great conference with Mr. Al Gore. I was in Mexico City attending an event where Mr. Gore presented what the climate would look like if we did not act quickly and reduce our carbon emissions. That day, Mr. Gore’s team made his “models” available for everyone to study and play with. He told me that the largest desert in the world would be what used to be Mexico, California, Nevada, Arizona, New Mexico, and Texas, all the way to the State of Mexico. He didn’t know if Mexico City would be a part of it because of its altitude. That day, we walked several miles to our dinner because of the bad news.

Your best effort is fine; we don’t need 20% of the people doing everything right. We need 80% of the people doing their

Introducing: Climate Resilience Technology

Alpha Impact 8 Ventures is pleased to announce that we are adding a third investment vertical to our thesis: Climate Resilience Technology.

Climate Resilience Technology encompasses digital solutions designed to help communities, businesses, and ecosystems adapt to and recover from the impacts of climate change. We're looking for scalable technologies addressing existing problems caused by climate change.

Our focus areas include:

AgFinancing: Integrating advanced technologies and tailored financing solutions to improve access to capital for agricultural growth and trade, enhance food security, boost productivity, predict disruptions, and optimize logistics.

Water Management Systems: Utilizing advanced technologies and financing solutions to address water scarcity and inefficient water use exacerbated by climate change.

Energy Management and Optimization: Implementing advanced technologies and financing solutions to tackle increased energy demand and grid instability due to extreme weather conditions. This includes smart grids, microgrids, energy management software, and demand response systems that optimize energy use, integrate renewable energy sources, and enhance grid resilience.

Data, Analytics, and Predictions: Companies that utilize data and advanced analytics to predict and mitigate disruptions and climate-related events. These solutions provide crucial insights and foresight, helping communities and businesses to prepare and respond effectively to climate challenges. Advanced technologies and artificial Intelligence to enhance supply chain visibility, predict disruptions, and optimize logistics ensure continuity and efficiency.

AlphaInsights: Venture Capital Report 2023

Alpha Impact 8 Ventures is thrilled to share our latest insights into the dynamic world of investments with our 2023 Venture Capital Report, here’s an updated version with 2024 commentary that dives into the ever-evolving landscape of financial markets.

Just a few months ago, Michael Burry, the legendary fund manager who famously profited from shorting the US housing market in 2008, bet more than $1.6 billion on a Wall Street crash by shorting the S&P 500 and Nasdaq-100. Warren Buffett’s money pile reached record highs of $157 billion as Berkshire Hathaway disposed of a net $33 billion of stocks over the past three quarters. Is there something Buffett and Burry know that the rest of us don’t?

Alpha Impact 8 Ventures is disrupting the industry, generating wealth, creating technology, providing access, leveling the play field, reducing systemic barriers, and building a resilient world.

Become part of the our revolution.

Happy reading,

AI8 Ventures’ Research & Investment Team